Longling Capital, a prominent player in the crypto world based in China, is back in the spotlight. Today, the firm once again poured money into an altcoin project, capitalizing on a bottom price. Here are the details and price targets.

Altcoin Hunter Longling Capital Back in Action

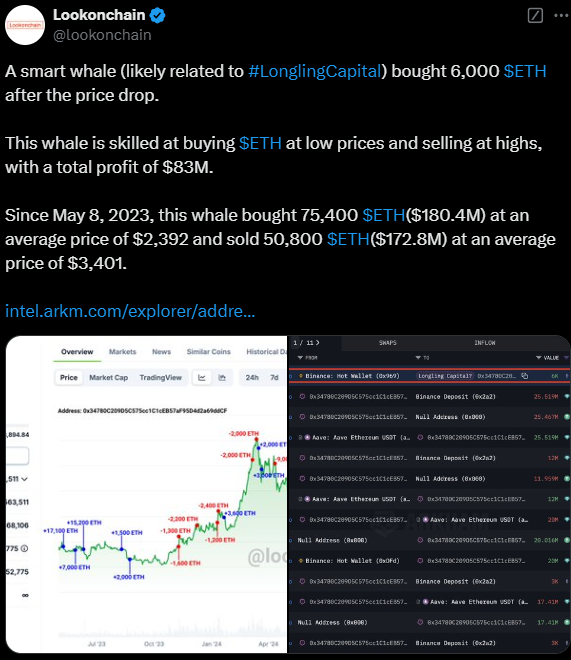

Chinese investment firm Longling Capital has once again seized the opportunity presented by the recent correction in the altcoin market. Following Bitcoin’s local peak at $106,000 and subsequent decline, the altcoin market mirrored this downtrend. Longling Capital reacted swiftly, purchasing 6,000 ETH after Ethereum’s price dropped. Known for buying low and selling high, the whale has reportedly amassed a total profit of $83 million. Its notable trading activity since May 8, 2023, continues to draw attention.

- Buying Strategy: Since May 2023, the whale has accumulated 75,400 ETH at an average purchase price of $2,392.

- Selling Strategy: Over the same period, it sold 50,800 ETH at an average price of $3,401, generating approximately $172.8 million in revenue.

Longling Capital has established a reputation for its ability to analyze Ethereum’s price movements and accurately identify market bottoms. With its latest acquisition, the firm’s next strategic move is eagerly awaited, as are potential price movements in Ethereum.

The Significance of Whale Activity in Altcoin Markets

Whale activity plays a critical role in forecasting overall price trends in the crypto markets. Actions taken by high-volume players like Longling Capital can significantly influence market direction. For investors with expectations regarding Ethereum’s future, closely tracking such movements is essential.

Why Did Ethereum’s Price Drop?

ETH’s price dropped by 7% on Wednesday following the Federal Open Market Committee (FOMC) meeting, which projected only two rate cuts in 2025. Although rate cuts typically have a positive impact on markets, the reduced expectation from four to two led speculators to adopt a bearish stance, increasing selling pressure.

This decline wasn’t confined to the crypto market; traditional markets also felt the impact. The S&P 500 index dropped 2.90%, losing 175.48 points on Wednesday.

The FOMC-induced crash led to a double-top pattern forming on Ethereum’s chart. This technical formation is regarded as a sell signal, indicating a potential reversal of the previous uptrend. After rising by 11% in December to a yearly peak of $4,111, Ethereum’s price experienced a sharp 14% decline to $3,583, completing the double-top pattern. A break below the $3,656 and $3,539 support levels could confirm the pattern, potentially pushing ETH down by 13% to $3,080.

Exchange Withdrawals and On-Chain Activity

Data from Santiment revealed that ETH held on exchanges dropped from 10.80 million on December 16 to 10.61 million by December 19. This translates to an outflow of approximately 190,000 ETH (worth $7 billion) from centralized platforms. This reduction often signals bullish sentiment as investors choose to secure their holdings off exchanges, reflecting confidence in Ethereum’s near-term performance.

For further details on Ethereum’s price predictions, including expectations for a $5,000 valuation, check out related articles on Kriptokoin.com.