Some experts expect a market crash after Bitcoin’s halving event. They give 6 reasons for this. For example, Bitcoin and Ethereum’s giant options expire on Friday. The Bitcoin historical model shows the Bitcoin price below $60,000 at the end of April. Tensions between Iran and Israel continue to escalate. And others

Bitcoin options expiry

As you have been following on Kriptokoin.com, the Bitcoin halving will take place on Saturday, April 20, according to forecasts. However, over $2 billion worth of Bitcoin and Ethereum options will expire on Friday. A total of 21 thousand Bitcoin options will expire with a notional value of $1.35 billion. The Put-Call ratio will be 0.64 and the maximum pain point is set at $66,000. In addition, 27,785 Ethereum options will also expire with a put-call ratio of 0.49. The maximum pain point will be $3,150.

Both Bitcoin and Ethereum are trading below their maximum points. This is causing high volatility in the crypto market. On April 26, 88,000 Bitcoin options with a notional value of $5.5 billion will expire. Also, calls are expected to be significantly higher than open interest. After Bitcoin’s halving, the BTC price is likely to trade below $60,000. Ethereum, on the other hand, could trade below $3,100 with 860,000 ETH options with a face value of $2.6 billion. In this case, the market would gain more than $8 billion from Bitcoin and Ethereum options.

Bitcoin historical pattern

As Bitcoin’s halving event approaches, Bitcoin and the crypto market have experienced a pre-halving sell-off. Forbes’ Elja Boom notes that Bitcoin has been on a downward trend and believes that this trend will continue. Boom expects sideways movements for a few months.

Fed rate cut delay and macro uncertainty

CPI, PPI and PCE inflation figures came in high in the US. Therefore, the Federal Reserve will most likely postpone rate cuts. Fed Chairman Jerome Powell and Vice Chairman Philip Jefferson have already signaled this. BTC price also fell on the CPI data. JPMorgan and other Wall Street banks predict that high inflation will continue for a while. Also, analysts predict that the BTC price will fall below $60,000. Markus Thielen, on the other hand, says that the price could go as low as $52,000 before a rally.

Rising Iran-Israel tensions

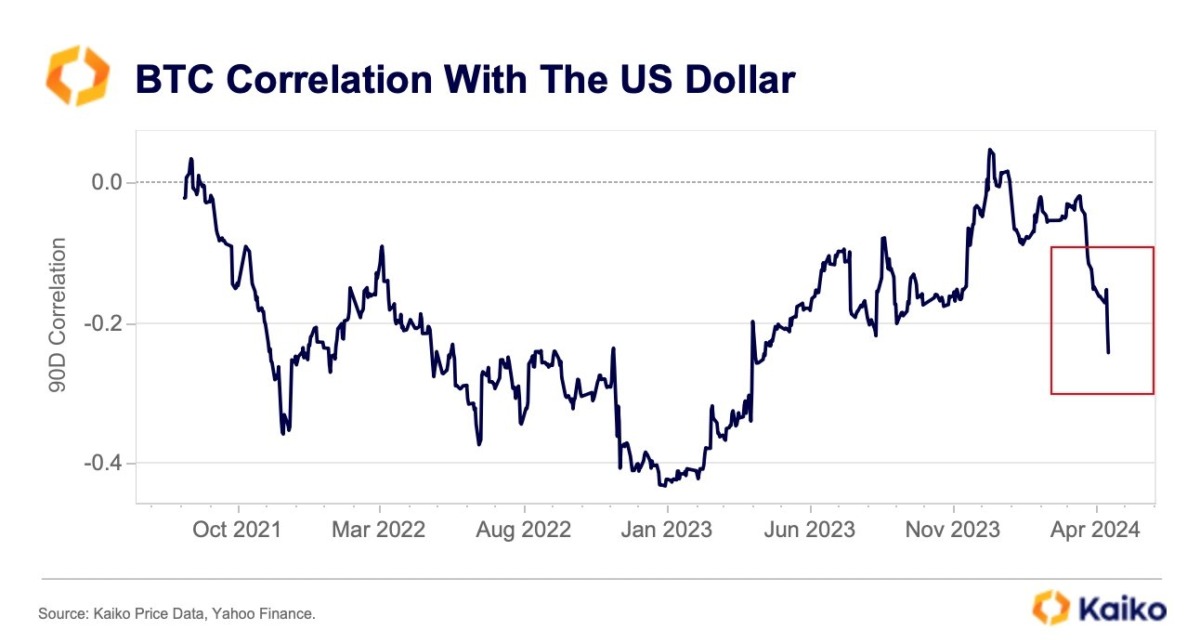

Tensions between Iran and Israel led to a $500 billion loss in crypto liquidations. Meetings held in Israel in response to Iran’s airstrikes were not enough to ease tensions. These events caused the US dollar index to rise above 106, the highest level since early November. After the developments, the BTC price fell to $60,000. According to Kaiko’s data, Bitcoin’s 90-day correlation with the DXY dropped to negative 0.24. Thus, it fell to its lowest level in years.

Outflows from Bitcoin ETFs continue!

Spot Bitcoin ETFs saw net outflows of $ 165 million on Wednesday. Thus, this was the fourth consecutive outflow this week. Bitcoin ETF buying activity has dropped significantly over the past few days, likely due to falling institutional interest and tax filings in the US.

BTFP end due to ‘bank-run’

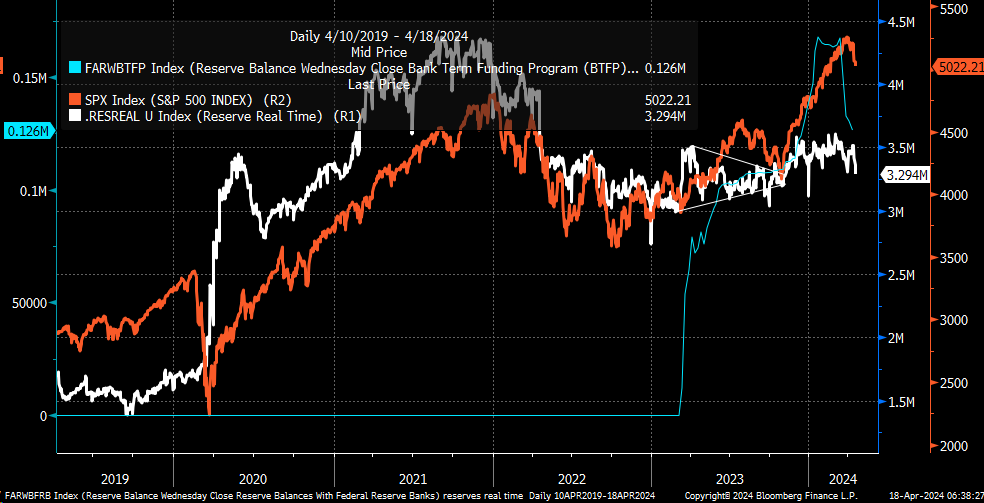

Treasury Reserve balances are declining rapidly as NPL and BFTB fall. Without the BFTP, banks are more likely to struggle as the Fed delays rate cuts. The BFTP was created by the Federal Reserve as an emergency loan program to banks. With some banks failing in March 2023, the Fed and the Treasury Department increased support for the BFTP to provide support to banks. Experts state that with the suspension of the BFTP, a large part of the liquidity has been withdrawn.

Follow us on Twitter, Facebookand Instagram, and join our Telegram and YouTube channelto stay up to date with breaking news !